Nj Cash Buyers Fundamentals Explained

Nj Cash Buyers Fundamentals Explained

Blog Article

Not known Facts About Nj Cash Buyers

Table of ContentsThe Facts About Nj Cash Buyers UncoveredNj Cash Buyers Fundamentals ExplainedThe Only Guide for Nj Cash BuyersTop Guidelines Of Nj Cash BuyersGetting My Nj Cash Buyers To WorkSome Known Details About Nj Cash Buyers Some Known Details About Nj Cash Buyers

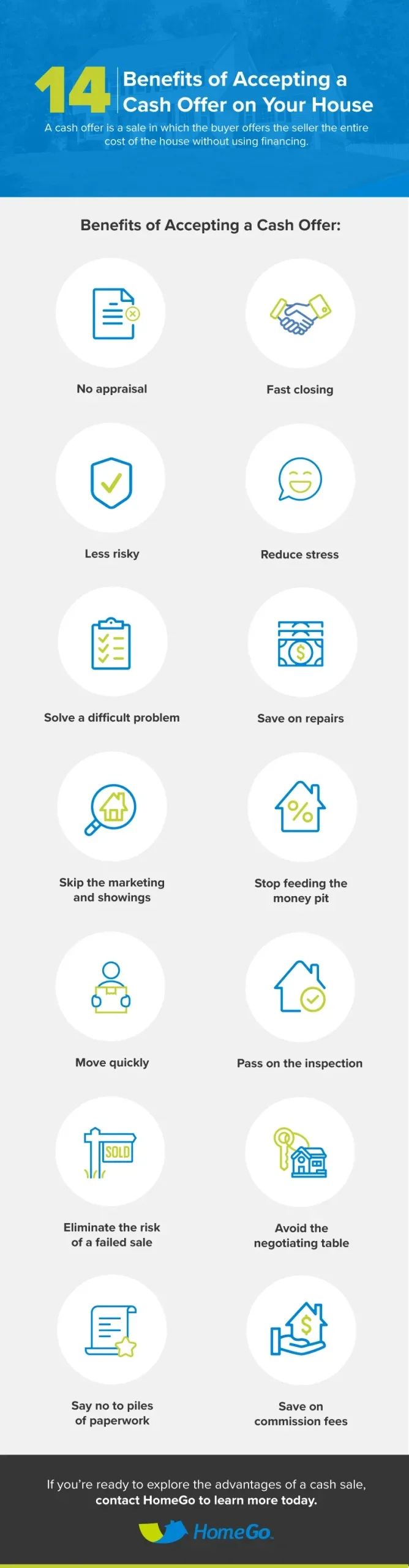

Cash offers also supply a sense of protection for the seller as they get rid of the threat of an offer falling via because of funding concerns. Overall, the benefits of money offers are clear, making it a prominent option for vendors wanting to streamline their home selling procedure. For informative functions only.

While home-sellers will likely conserve thousands in commission, compliance and litigation dangers have significantly increased for sellers throughout the nation. These types of homes are usually had by people that want to market their residential or commercial property quickly, and for this factor, they favor money home buyers.

It is possible to acquire a home with cash money. There are both advantages and downsides to paying cash for a house. Advantages consist of immediate home equity and the opportunity to eliminate expenditures like private home mortgage insurance coverage. It likewise consists of assurance from not needing to make month-to-month finance settlements.

9 Simple Techniques For Nj Cash Buyers

Nonetheless, using cash money to acquire a home bind a sizable portion of funding in an illiquid property, postponing immediate access to cash. It additionally implies losing on particular tax obligation breaks associated with rate of interest paid on a mortgage. Consider your goals, economic condition, and tax exemptions prior to acquiring a home with cash.

Purchasing a home in cash money can deplete your fluid properties, leaving you with restricted funds for emergency situations. It's necessary to make sure that you still have adequate cash gets or accessibility to line of credit. One advantage of securing a home mortgage is the possible to subtract the rate of interest paid on the finance.

Others are comfy bring home mortgage financial debt and leveraging their assets for possible growth. Acquiring a house with cash has more benefits than drawbacks, which include: By paying in money for the home, you get rid of the need to pay interest on a mortgage. This can save you a considerable quantity of cash over the car loan's life.

Some Known Facts About Nj Cash Buyers.

By paying cash money, you miss out on this tax obligation benefit. Owning a home outright can leave you with restricted liquid assets available for emergencies, unexpected expenses, or other financial needs. Here are some compelling factors to take into consideration obtaining a home loan instead of paying cash for a house:: By obtaining a home loan, you're able to utilize your investment and potentially accomplish greater returns.

(https://www.reddit.com/user/njcashbuyers1/)Rather than linking up a considerable amount of money in your home, you can keep those funds available for other financial investment opportunities.: By not placing all your available cash right into a solitary possession, you can keep an extra varied investment profile. Profile diversity is a key threat management approach. Paying money for a house uses various advantages, boosting the percentage of all-cash realty deals.

The cash money purchase residence process entails binding a significant section of liquid possessions, potentially restricting financial investment diversity. On the other hand, obtaining a mortgage allows leveraging financial investments, preserving liquidity, and potentially profiting from tax obligation advantages. Whether getting a home or home loan, it is necessary to rely upon a reputable actual estate platform such as Houzeo.

The Facts About Nj Cash Buyers Uncovered

With thousands of residential property listings, is one of the biggest residential or commercial property noting sites in the United States. Yes, you can get a house with cash money, which is much easier and useful than applying for mortgages.

Paying money for a home links up a big quantity of your liquid assets, and restrict your financial versatility. In addition, you lose out on tax obligation benefits from mortgage rate of interest deductions and the chance to invest that cash money in other places for possibly greater returns. Professionals suggest that even if you have the cash money to purchase a residential property, you ought to obtain a home mortgage for tax exemptions and much better liquidity.

Things about Nj Cash Buyers

All-cash sales are becoming increasingly prominent, accounting for nearly 40% of single-family home and condominium sales in Q2 2024, according to real estate information firm ATTOM. cash for homes nj. In 2023's seller's market, many customers had the ability to win quotes and save cash on interest many thanks to cash offers. Cash money transactions frequently lead to a quicker closing process, which entices vendors to approve such proposals.

These expenses are typically reduced in a cash sale than in a standard sale, but they still need to be covered.

4 Easy Facts About Nj Cash Buyers Explained

Cash purchasers have an edge when bargaining since vendors prefer to do business with those that can close quickly without needing backups to finance an acquisition. This can cause discount rates or desirable terms which increase profitability for a financial investment decision. Money purchasers do not need to stress regarding rates of interest fluctuations and the feasible repossession dangers that accompany leveraged financial investments, making cash purchases feel much safer during financial downturns.

By paying money for a rental home purchase, you are securing away resources that might or else have actually been deployed somewhere else and generated higher returns. Acquiring with such large amounts limitations liquidity and diversity along with impedes total profile growth. Cash money buyers frequently forget the advantages of making use of other people's funds as home mortgages to raise financial investment returns significantly faster, which might postpone wide range build-up exponentially without leveraged financial investments.

Cash money buyers might lose out on particular reductions that could injure total returns. An investment that entails allocating significant sums of cash towards one residential property might present concentration risk if its performance suffers or unexpected troubles emerge, giving higher security and strength throughout your profile of residential properties or possession courses.

Nj Cash Buyers Can Be Fun For Anyone

There has always been a competitive benefit to making an all-cash offer, yet when home loan rates are high, there's another: Borrowing money is pricey, and paying for the home in full helps you prevent the monthly obligation of home mortgage payments and passion. More individuals have taken this path in recent times, with the portion of purchasers making use of a home loan to acquire a home dropping from 87 percent in 2021 to 80 percent in 2023, according to the National Association of Realtors' latest Account of Home Customers and Sellers. Naturally, the majority of Americans do not have hundreds of hundreds of bucks lying around waiting to be spent.

Even if you can afford to purchase a home in cash money, should you? Yes, it is possible and perfectly lawful to acquire a home in complete, simply as you would certainly a smaller-ticket item like, state, a coat.

Report this page